Mortgage Data Entry Company | Mortgage Data Entry Services Outsource

Mortgage Data Entry Services Company | Mortgage Data Entry Services | Mortgage Deeds Data Extraction | Outsource Mortgage Data Entry Services | Mortgage Data Entry Services in India

In the fast-paced world of mortgage processing, accurate and efficient data entry is crucial. Whether it’s online or offline, image or form-based, mortgage data entry services play a vital role in ensuring smooth operations and minimizing errors.

Mortgage data entry services encompass a range of tasks, including entering information from various sources into databases, verifying and analyzing data for accuracy and compliance, processing mortgage forms, conducting open-ended research on mortgages, and even handling commercial mortgage data. These services are designed to streamline the mortgage process and free up valuable time for lenders and financial institutions.

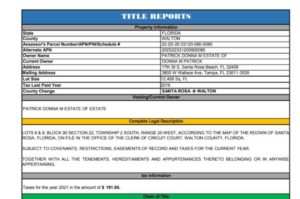

One key aspect of mortgage data entry is image-based data entry. This involves extracting information from scanned documents or images related to mortgages and inputting it into relevant systems accurately. By utilizing advanced OCR (Optical Character Recognition) technology, these services ensure that even handwritten or complex documents can be digitized efficiently.

Additionally, mortgage data verification and analysis are essential steps in maintaining the integrity of the information being processed. Thoroughly reviewing each entry for consistency and compliance helps identify any potential errors or discrepancies before they become larger issues down the line.

Mortgage Data Entry

Mortgage online and offline data entry, Mortgage image data entry, Mortgage form data entry, Mortgage data verification and analysis, Mortgage form processing, Open ended mortgage data entry, Commercial mortgage data entry, Mortgage web research, Foreclosure data entry, Mortgage documents entry & processing, Mortgage document indexing, Mortgage foreclosure data entry, Mortgage deed processing, Taxation data entry, Mortgage data migration services, Title data entry, Property records management, Mortgage Documents Entry And Processing, Invoice And Bills Entry, Borrower Name, Lender Name, REID number, Substation Trust Deed, Trustee Name, Loan Amount, Property Addresses, Property photos, Mortgage, Mortgage Underwriting, Mortgage Appraisal, Mortgage Closing, Mortgage Data Entry, Mortgage data verification and analysis, Mortgage Deed Processing, Mortgage Documents Data Entry, Mortgage Documents Entry, Mortgage Documents Services, Mortgage Entry, Mortgage form data entry, Mortgage form processing, Mortgage image data entry, Mortgage Indexing Services, Mortgage online and offline data entry, Mortgage Online/Offline Data Entry, Mortgage Post Closing, Mortgage Processing, Mortgage Title Support, Mortgage web research, Records Retrieval, County Recording, Other Court Services, Accurate Property Data for Real Estate Professionals, Accurate Property Data, Real Estate Professionals, Records Retrieval, County Recording & Other Court Services, Court document retrieval, Courthouse Retrieval System, Civil Court Case Search & Records Retrieval, Civil Court Case Search, Courthouse Retrieval – Services, Courthouse Retrieval Services, Court Research & Document Retrieval, Nationwide Document Retrieval Services, Nationwide Document Retrieval, Document Retrieval Services

Mortgage web research is another valuable service offered by providers in this field. It involves gathering information from various online sources to support decision-making processes related to mortgages. This could include researching property values, market trends, foreclosure rates, or any other relevant factors that impact the industry.

Overall, outsourcing mortgage data entry services can significantly enhance productivity while reducing costs associated with manual processing. By leveraging technology-driven solutions combined with human expertise, these services ensure accuracy and efficiency throughout the entire mortgage workflow – from initial form processing to final analysis.

In conclusion, whether you’re a lender looking to streamline your operations or a financial institution seeking reliable support for your mortgage processes – professional providers of mortgage data entry services offer tailored solutions that can help you stay ahead in this competitive industry while ensuring compliance with regulatory requirements.

Mortgage data entry services are essential for efficiently managing and organizing large volumes of data related to mortgages. These services involve accurately entering and updating information such as borrower details, loan terms, property information, and financial data into a database or system.

Outsourcing mortgage data entry services can be a smart choice for mortgage companies, lenders, and financial institutions. By partnering with a reliable outsourcing provider, you can benefit from their expertise and specialized tools to ensure accurate and efficient data entry.

Outsourcing mortgage data entry services offer several advantages. Firstly, it allows mortgage companies to focus on their core business activities, such as loan processing and customer service, while leaving the data entry tasks to skilled professionals. This can help streamline operations and increase overall productivity.

Secondly, outsourcing mortgage data entry ensures a high level of accuracy. Experienced data entry professionals are trained to handle complex mortgage-related data and can minimize errors, ensuring that the information entered is reliable and consistent. This accuracy is vital for maintaining the integrity of mortgage records and complying with regulatory requirements.

Additionally, outsourcing mortgage data entry services can help with scalability and flexibility. If your organization experiences fluctuations in data entry requirements, an outsourcing partner can quickly scale their operations up or down according to your needs. This ensures that mortgage data is entered promptly and efficiently, even during peak periods.

Furthermore, outsourcing mortgage data entry services can lead to cost savings. Instead of investing in expensive infrastructure and hiring and training in-house staff, outsourcing allows you to leverage the expertise and resources of the service provider. This can result in reduced overhead costs and improved cost-efficiency.

In conclusion, outsourcing mortgage data entry services can bring numerous benefits, including increased efficiency, improved accuracy, scalability, and cost savings. By entrusting your mortgage data entry tasks to a reliable outsourcing partner, you can focus on core business activities and ensure that your mortgage operations run smoothly and effectively.